For this article, the focus will be on common cash flow problems and solutions that international businesses may face. While revenue and profits signal strong financial performance, cash flow drives growth. For a business to thrive, cash inflows and outflows must be timed cyclically. This is not easy, as businesses often face several cash flow hurdles along the way. Ideally, all businesses should have a reserve of cash set aside for these types of scenarios.

As you work through the list of refining your process to prevent cash flow problems, keep the following five signs in mind to help you avoid common cash flow issues. Regular calculation, analysis and forecasting are essential to avoid poor financial planning. A cash flow forecast will help predict the months that might see a cash deficit or surplus – keep it conservative and plan accordingly. You’ll get a good idea of how much cash you might have on hand or how much cash you’ll need. Cash flow errors are exceptionally common for SMEs’ undergoing high growth phases – unchecked growth increases your future receivables and significantly hikes up current expenses.

Common Small Business Cash Flow Problems and How to Solve Them

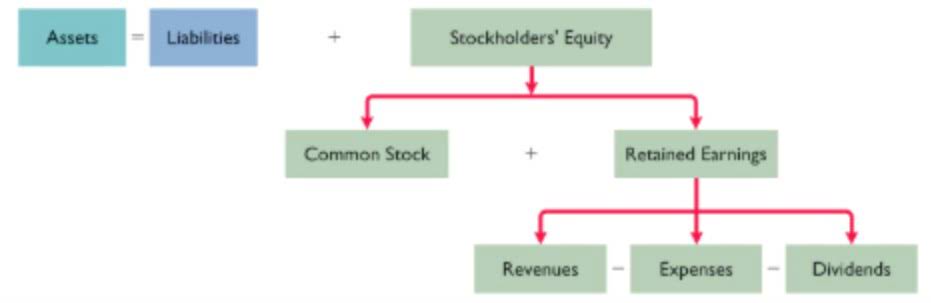

In essence, a cash flow problem can be defined as a situation where total debt exceeds total revenue in a given time period, resulting in a net negative flow of cash into the business. These problems are incredibly damaging to business operations, as negative cash flow makes it much more difficult common cash flow problems to deploy capital or invest in growth. In the worst case, cash flow problems can lead to insolvency – the inability to pay creditors in line with established payment terms. This equates to a situation where the outflow is greater than the inflow for the product sold within that accounting period.

- This situation will quickly become unsustainable without a large cash reserve and negatively impact your cash flow position.

- But when it happens too quickly or without a proper plan in place, it can end up backfiring.

- As you bring on more employees and inventory, operating costs will increase.

- Are there expenses that you can reduce without a large business impact?

- Of all the primary reasons why businesses struggle with cash flow, one of the most cited is problems with late payments.

- Foresight is very important before businesses can undertake global expansion.

However, if you are not mindful when managing the business’ capital/free cash flow, it could lead to trouble. Not investing enough will hamper your growth as a business, and it’ll get increasingly difficult to stay in the market without suffering as a business. Plus, customers and sales go down as a result, leading to financial distress. Doing so can help spot problems early on so that companies can take proactive measures to solve issues. In addition, preparing a cash flow statement as part of regular financial reporting provides better oversight into the business’ cash position.

Regulatory changes:

To compensate for rapid growth, make sure you’ve planned ahead and given yourself enough time to build a “safety net” cash reserve in case of an emergency or unexpected event. Also, further knowledge on what is cash flow management can help to gain a strategic understanding on how these measures could be implemented for maximum operational efficiency. This company is a classic example demonstrating the severe repercussions of poor cash flow management.

- If cash flow is not effectively managed, particularly operating cash flow – such as everyday expenditures-, it becomes more difficult for businesses to continue running as normal.

- Not investing enough will hamper your growth as a business, and it’ll get increasingly difficult to stay in the market without suffering as a business.

- You have cash flow problems when the cash generated by your business is less than expenditures – cash outflow exceeds the cash inflow.

- However, an overstock is a sign of poor inventory management and slow business growth.

- While you can’t predict every little problem that might pop up, you can prepare for most.

- The absence of a “predictable paycheck” is scary, but the rewards of owning your own business far outweigh those risks.

A cash flow problem in business is when the cash coming in no longer outweighs the cash going out. Pricing products and services is one of the most challenging components of running a small business. While it can be relatively easy to determine pricing if you’re selling commodities or consumer goods, it gets fuzzy when you’re selling a unique service or product. Your first step should be establishing a spending budget based on cash flow. For example, if you intend to invest in a new software environment, map out beforehand how each piece of software will work together to drive value.

Small Business Cash Flow Problems and How to Solve Them

Cash flow analysis should be conducted periodically to monitor your business’s financial health. A monthly accounting period is a common timeframe to calculate and track your company’s cash position. A low profit margin indicates that either your costs are too high, your price is too low or both.

When starting a business, it’s crucial to do it right by having the needed reserves from the beginning. That’s where forecasting can be incredibly helpful to help you see what your business will require before you start earning. Foresight is very important before businesses can undertake global expansion. When considering new markets, it’s important to pause at the ideation stage and plan. Cash flow problems occur when the business cannot cover cash outflow due to a lack of cash inflow.

Enhanced profitability:

This budget can be more useful than a standard budget in the day-to-day running of your business because it will help you get a handle on your cash position at any point in time. Let’s look at seven cash flow problems and how small businesses can work to solve them. Minimizing late customer payments often comes down to reviewing your payment terms. Article by Oliver Munro in collaboration with our team of specialists.